-40%

Trading Systems | Expert Advisors | Forex MT4 Indicator-Ichimoku Chikou Cross EA

$ 21.77

- Description

- Size Guide

Description

Ichimoku Chikou Cross Expert Advisor (EA)Description:

Ichimoku Chikou Cross Expert Advisor is based on standard Ichimoku Kinko Hyo indicator with default settings. Specifically, it uses the cross of Chikou span with price to generate trading signals. The signals are confirmed by the relative position of current price and Kumo. Additional confirmation comes from relative position of latest Chikou span level and Kumo at that time. The expert advisor does not use any stop-loss or take-profit levels but exits all trades on reverse signals that, in contrast to entry signals, do not require any confirmation.

Characteristics of Ichimoku Chikou Cross EA

Platform: Metatrader4

Currency pairs: EUR/JPY, USD/JPY, GBP/JPY

Trading Time: Around the clock

Timeframe: D1, H4

The Ichimoku Kinko Hyo indicator consists of five main elements:

Tenkan-sen ("turning line"): a 9-period fast moving average based on High-Low difference rather than traditional Close levels

Kijun-sen ("standard line"): a 26-period slow moving average based on High-Low difference rather than traditional Close levels

Senkou Span A ("1st leading line"): average of Tenkan-sen and Kijun-sen plotted with some shift in the future

Senkou Span B ("2nd leading line"): average of maximum and minimum price for the given period plotted with the same shift in the future

Chinkou Span ("lagging line"): price Close level plotted with the same shift but in the past.

Senkou Span A and B together form what is known as Kumo cloud.

The chart below shows the five elements in their complete set-up:

Apparently, there are different ways to trade with Ichimoku Kinko Hyo: one can trade the Tenkan/Kijun cross, like the MACD, or trade the Kumo cross, or trade the cross of price with any of Ichimoku's five lines.

Trading Strategy

Wait until a new bar opens.

Get two latest (completed) Chikou span values. Basically, they are nothing more than two latest price Close levels, but they are visually shifted back by Kijun period bars.

Get two price Close levels at the time when those Chikou span values are displayed — i.e. Close price levels with the same shift to the past.

If current Chikou is above respective Close level and the previous Chikou was below or at the same level as respective price Close, a bullish signal is generated and a bearish signal is invalidated.

If current Chikou is below respective Close level and the previous Chikou was above or at the same level as respective price Close, a bearish signal is generated and a bullish signal is invalidated.

If current Chikou is at the same level as the respective price Close, both bearish and bullish signals are invalidated as, obviously, the Chikou/price cross is ongoing and there is no telling where will it turn.

Get the values of Senkou Span A and B at the time of latest (completed) price Close.

If Close is above both Senkou Span A and Senkou Span B, bullish signal is confirmed.

If Close is below both Senkou Span A and Senkou Span B, bearish signal is confirmed.

Get the values of Senkou Span A and B at the time of latest completed Chikou span.

If Chikou span is above both Senkou Span A and Senkou Span B, bullish signal is confirmed.

If Chikou span is below both Senkou Span A and Senkou Span B, bearish signal is confirmed.

If there is a bullish signal, close a short position (if there is any) and check confirmations. If both bullish confirmations are present, open a long position and invalidate the bullish signal.

If there is a bearish signal, close a long position (if there is any) and check confirmations. If both bearish confirmations are present, open a long position and invalidate the bearish signal.

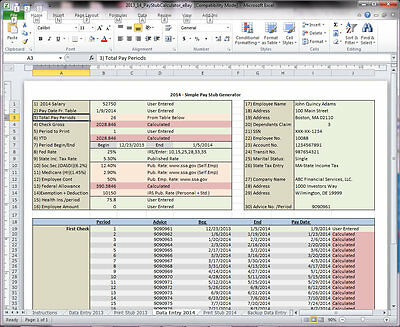

Back-tests

of Ichimoku Chikou Cross EA

Testing was performed on the time interval 2016.11.09 - 2017 .07.13 with different parameters for GBP/JPY, USD/JPY, EUR/JPY, please check the Photos bellow and it gave us a GREAT performance, especially on H4 timeframe.

Please note:

Buying this Ichimoku Chikou Cross EA, you will have a

FULL ACCESS

to the Code and Parameters.

For All other products Please Check My

Other Items.

Payment & Shipping

*******************************************************

We Accept PayPal Only

World Wide FREE SHIPPING

We Ship Items Within 24 hours When Receiving Cleared Payment From Buyer

( Deliver To Your PayPal Email Address )

( WE DON'T SEND CD OR ANY OTHER HARD COPY TO YOUR PHYSICAL ADDRESS )

Thanks For Your Visit

RETURNS AND GUARANTEE

Since I am selling software, which is not a tangible good or service, I cannot accept returns, and hence do not issue refunds. However, you have my solemn guarantee that all material featured on this listing is truthful, genuine, and representative of the product. All indicator screen shots featured in this listing are real, and were NOT manipulated in any manner.

FEEDBACK

We do our best to have a 5-star rating.

Please let us know how we can make your experience a five-star rated one.

When you are happy with your purchase, please leave us a 5-star rating feedback and we will do the same for you!

RISK DISCLAIMER

The application displayed on this page does not take in to consideration your individual personal circumstances and trading objectives. Therefore, it should not be considered as a personal recommendation or investment advice. Past performance is not indicative of future results. There is no guarantee that the systems, trading techniques, trading methods, expert advisors (EAs), scripts and/or indicators will result in profits or not result in losses.