-40%

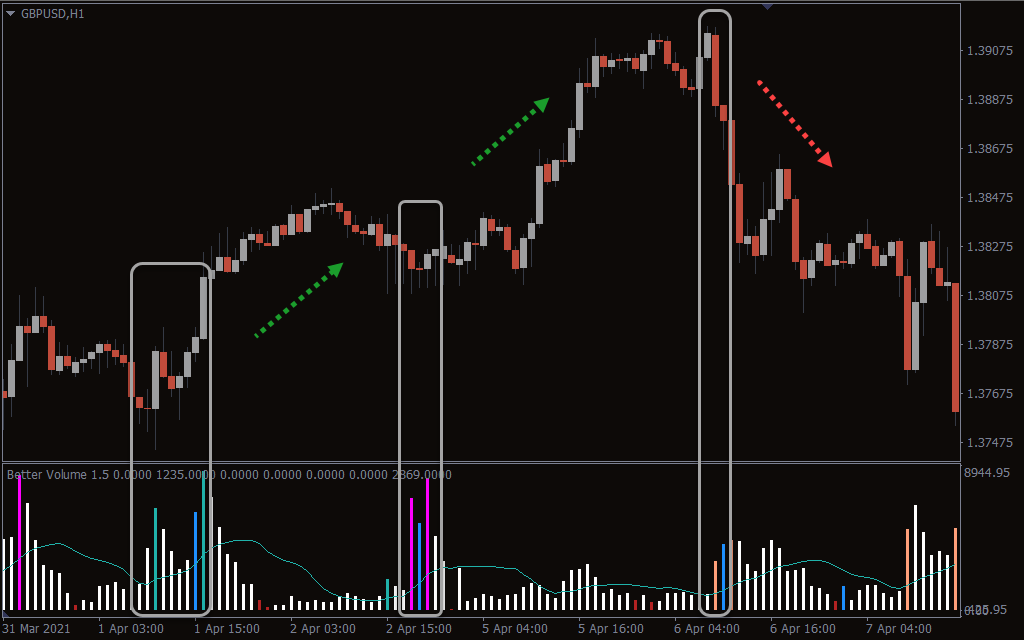

600 pips Better Volume New Alerts forex trading system indicator mt4 2021

$ 0.17

- Description

- Size Guide

Description

600 pips Better Volume New Alerts forex trading indicator mt4 2021Determine Forex and Stock Buy Sell intraday signals with the Better Volume Indicator MT4 . Detects trend reversal patterns. Offers better trading solutions than regular volume-based indicators.

The Better Volume New Alerts Indicator represents one of the best volume-based indicators in the market. As a technical tool, it determines the balance between the supply and demand of the securities. Also, it can distinguish the difference between the expected average trading vol. and the actual results.

This indicator is ideal for analyzing market trend, price volatility, and determining the probability of the potential trade setups. Moreover, it helps traders in assessing the market sentiment which is very useful for day trading activities.

Furthermore, this indicator comes with BetterVolume 1.5 which is the latest version of this vol. analyzing tool. The latest edition is easy to read, simple to use, and especially suitable for beginner-level traders.

In this guide, we’ve explained how to use Better Volume 1.5 for buy-sell purposes including chart examples and MetaTrader 4 settings.

How to determine buy-sell signals using the Better Volume New Alerts Indicator in MT4

Generally, there are two types of volume indicators in the market:

Tick vol.

Real vol.

The tick indicator counts every single tick of the price movements within the selected timeframe periods. On the other hand, the real counts the total number of lots traded during the formation of a candlestick. The real vol. is suitable for trading stock items. Counting the total number of trading volumes for forex instruments is quite unrealistic. So, tick vol. is a better option for day trading individuals in forex.

It is important to understand the relation between volume and price before using volume based indicators in the real market. Please note that volume-based indicators do not generate straight buy sell signals. Instead, it gives you a market insight that showing the balance between the supply and demand of the assets.

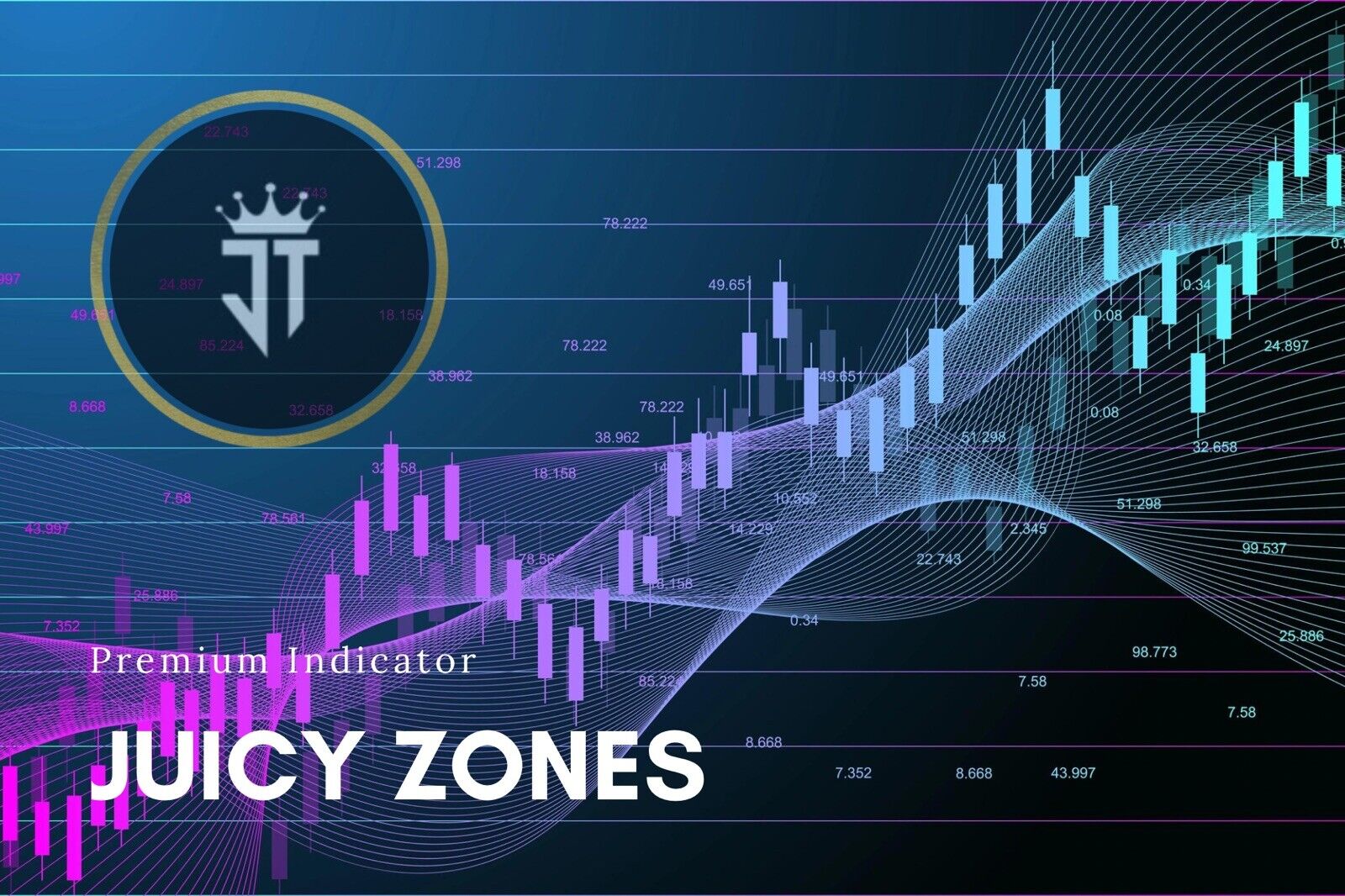

In this above chart, initially, the price rejected to move lower and rebounded upwards. At the same time the volume increases (1) supporting the bullish move of the price. Such setup indicates the price is possibly going to continue its bullish move.

At the second setup, you can see the price denying a bearish move, instead, it plots multiple bullish pin bars. The rejections were supported well by a large increase in volume (2). Later, the price continued to rally upwards with positive vol. support.

Now, at the third setup, the vol. increased (3) but the price stopped moving higher and failed to create a new high. This means the volume is no longer supporting the current bullish move of the price. We’ll consider such conditions as a trend reversal setup.